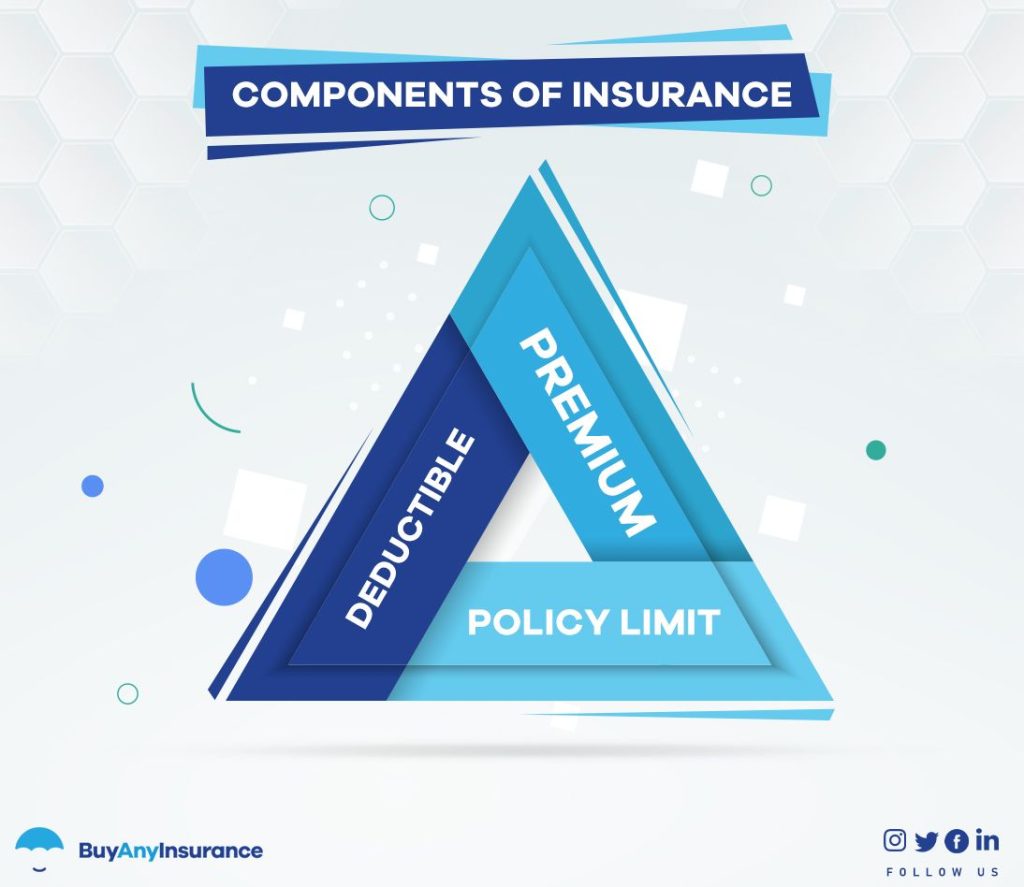

Premium: Understanding Your Policy’s Price Tag

The premium of your insurance policy is essentially its price tag, usually paid on a monthly basis. Insurers consider various factors when determining your premium, such as:

- Auto Insurance: Your history of auto and property claims, age, location, credit score, and other state-specific factors.

- Home Insurance: Property value, belongings value, location, claims history, and coverage levels.

- Health Insurance: Age, gender, location, health status, and coverage options.

- Life Insurance: Age, gender, tobacco use, health condition, and coverage amount.

Insurers evaluate your risk profile to assess the likelihood of you making a claim. For instance, owning multiple high-value cars with a history of reckless driving will likely result in higher auto insurance premiums compared to someone with a single modest vehicle and a clean driving record. However, premiums may vary among insurers, so it’s essential to shop around for the best deal.

Policy Limit: Understanding Coverage Maximums

The policy limit represents the maximum amount an insurer will pay for covered losses within your policy’s terms. These limits can be:

- Per Period: Such as annually or over the policy term.

- Per Loss or Injury: Setting a cap on individual claims.

- Lifetime Maximum: The maximum amount payable over the policy’s lifetime.

Generally, higher coverage limits translate to higher premiums. For life insurance, the maximum payout is known as the face value, which is disbursed to your beneficiaries upon your demise. Notably, the Affordable Care Act prohibits lifetime limits on essential healthcare benefits in compliant plans.

Deductible: Your Out-of-Pocket Obligation

The deductible is the amount you must pay before your insurer covers a claim. It acts as a deterrent to numerous small and insignificant claims. Here’s how it works:

- For instance, with a $1,000 deductible, you’re responsible for the first $1,000 of any claim. If your car sustains $2,000 in damages, you pay $1,000, and the insurer covers the remaining $1,000.

- Deductibles can apply per policy or claim, and health plans may have individual and family deductibles.

- Policies with higher deductibles are typically cheaper because the increased out-of-pocket expense results in fewer minor claims.