At the outset of the trading week, gold prices continue their upward trajectory, nearing the resistance level of $2182 per ounce amidst holiday-shortened sessions. This ascent brings them in close proximity to the psychological barrier of $2200 per ounce, reflecting resilience in the face of market dynamics.

Gold Analysis Today 26/3: Geopolitical Tensions

Amidst geopolitical tensions, gold prices have seen a weekly gain of approximately 0.3%, augmenting year-to-date increases by 5.1%. Silver prices have also exhibited strength, surpassing the $25 per ounce mark, despite a stable performance last week.

Factors Influencing Exchange Rates Federal Reserve’s Interest Rate Outlook

The anticipation of US interest rate cuts is a significant factor driving market sentiment. Although the Federal Reserve maintained the benchmark rate, indications from the Summary of Economic Projections (SEP) suggest a dovish stance, potentially impacting the dollar’s value.

Economic Calendar Insights

This week’s economic calendar highlights pivotal data, notably the US Personal Consumption Expenditures Price Index. Projections indicate potential market-moving impacts, shaping investor expectations and influencing exchange rates.

Market Dynamics

US Treasury Yields and Dollar Strength

US Treasury yields have shown an uptick, alongside the US dollar index (DXY) surpassing 104.00. Despite fluctuations, the DXY has appreciated by approximately 3% year-to-date, exerting pressure on dollar-denominated commodities like gold.

Other Commodity Markets

Copper, platinum, and palladium futures have demonstrated resilience, indicating broader market dynamics influencing commodity prices.

Exchange Rate Forecast

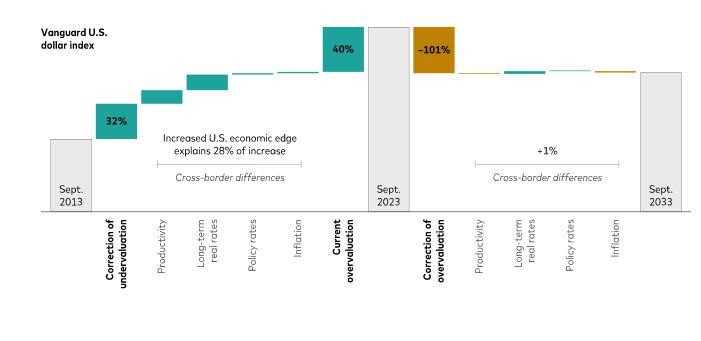

Our outlook suggests a potential easing in the dollar’s value, influencing returns on non-US equities for dollar-based investors. Geopolitical tensions and monetary policy outlooks are pivotal in shaping exchange rate trends.

Conclusion

In conclusion, the interplay of geopolitical tensions, economic data, and policy decisions underscores the dynamic nature of exchange rates. While short-term fluctuations may occur, long-term trends are influenced by fundamental economic conditions and cross-border variables.