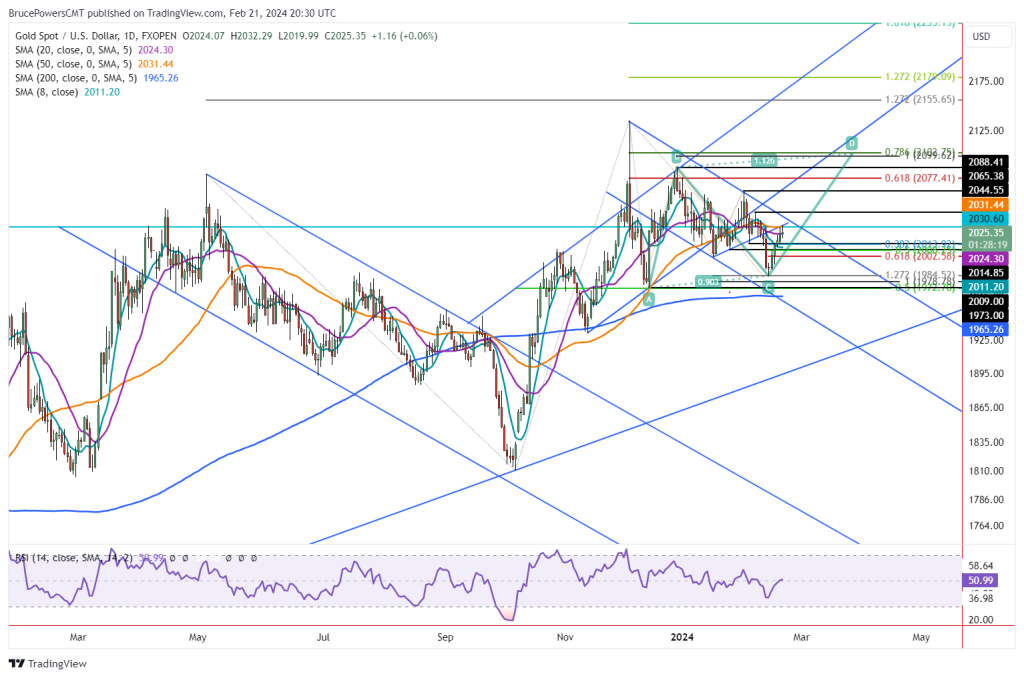

As the trading week commenced, gold prices sustained their upward momentum, nearing the critical resistance level of $2182 per ounce amidst shortened trading sessions due to holidays. This surge brings them tantalizingly close to breaching the psychological barrier of $2200 per ounce, underscoring their resilience in response to evolving market conditions.

Gold Market Analysis: March 26th, Geopolitical Considerations

Despite geopolitical tensions, gold prices recorded a weekly gain of approximately 0.3%, further bolstering their year-to-date increase of 5.1%. Notably, silver prices also demonstrated strength, surpassing the $25 per ounce threshold, despite exhibiting stability in the previous week’s performance.

Factors Shaping Exchange Rates

Federal Reserve’s Interest Rate Policy

Anticipation surrounding potential US interest rate adjustments remains a significant driver of market sentiment. While the Federal Reserve opted to maintain the benchmark rate, insights gleaned from the Summary of Economic Projections (SEP) hint at a dovish stance, potentially influencing the valuation of the US dollar.

Insights from the Economic Calendar

This week’s economic calendar highlights the significance of key data releases, notably the US Personal Consumption Expenditures Price Index. Projections regarding these data points have the potential to sway market expectations, consequently impacting exchange rates.

Market Dynamics

Impact of US Treasury Yields and Dollar Strength

A notable uptick in US Treasury yields, coupled with the US dollar index (DXY) surpassing the 104.00 mark, underscores the prevailing strength of the greenback. Despite intermittent fluctuations, the DXY has exhibited a year-to-date appreciation of approximately 3%, exerting downward pressure on dollar-denominated commodities such as gold.

Performance of Other Commodity Markets

Copper, platinum, and palladium futures have displayed resilience in the face of broader market dynamics, indicating a nuanced interplay of factors influencing commodity prices.

Exchange Rate Projections

Our analysis suggests a potential softening in the US dollar’s valuation, potentially impacting returns on non-US equities for investors holding dollar-denominated assets. Key determinants in shaping exchange rate trends include geopolitical developments and the trajectory of monetary policy decisions.

Conclusion

In summary, the multifaceted nature of exchange rate dynamics underscores the influence of geopolitical tensions, economic data releases, and policy decisions on market movements. While short-term fluctuations may occur, long-term trends are invariably shaped by fundamental economic conditions and global geopolitical variables.