In the wake of the COVID-19 pandemic, the resurgence of commuting and travel has coincided with a notable increase in car insurance costs. As more individuals return to work and hit the roads, the financial burden of car ownership, including insurance premiums, is becoming more pronounced.

Factors Driving Insurance Premiums

H2: Rising Premiums Recent research conducted by The Ascent reveals a significant uptick in annual car insurance premiums, with the overall average now standing at $3,017. This surge has affected many Americans, with some experiencing premium hikes of nearly 30%, irrespective of their vehicle’s age or driving history.

H2: Financial Implications With the escalating costs associated with car ownership, including maintenance, fuel, and insurance, many drivers are seeking avenues to minimize their expenses. However, reducing insurance coverage altogether may not be the most prudent approach, considering the potential financial ramifications.

Strategies to Save on Car Insurance

H2: Switching Providers One effective strategy to mitigate rising insurance costs is to explore alternative insurance providers. Rather than remaining loyal to a single insurer, consumers are advised to shop around and obtain quotes from multiple providers. Websites like EverQuote and various insurance company apps offer a convenient platform to compare rates and potentially secure more affordable coverage.

H2: Improving Credit Score A higher credit score can translate to lower insurance premiums in most states. By enhancing their creditworthiness, individuals can unlock more favorable rates and save substantially on annual premiums. States that restrict the use of credit-based insurance scores are exceptions, but for the majority, a solid credit score can yield significant cost savings.

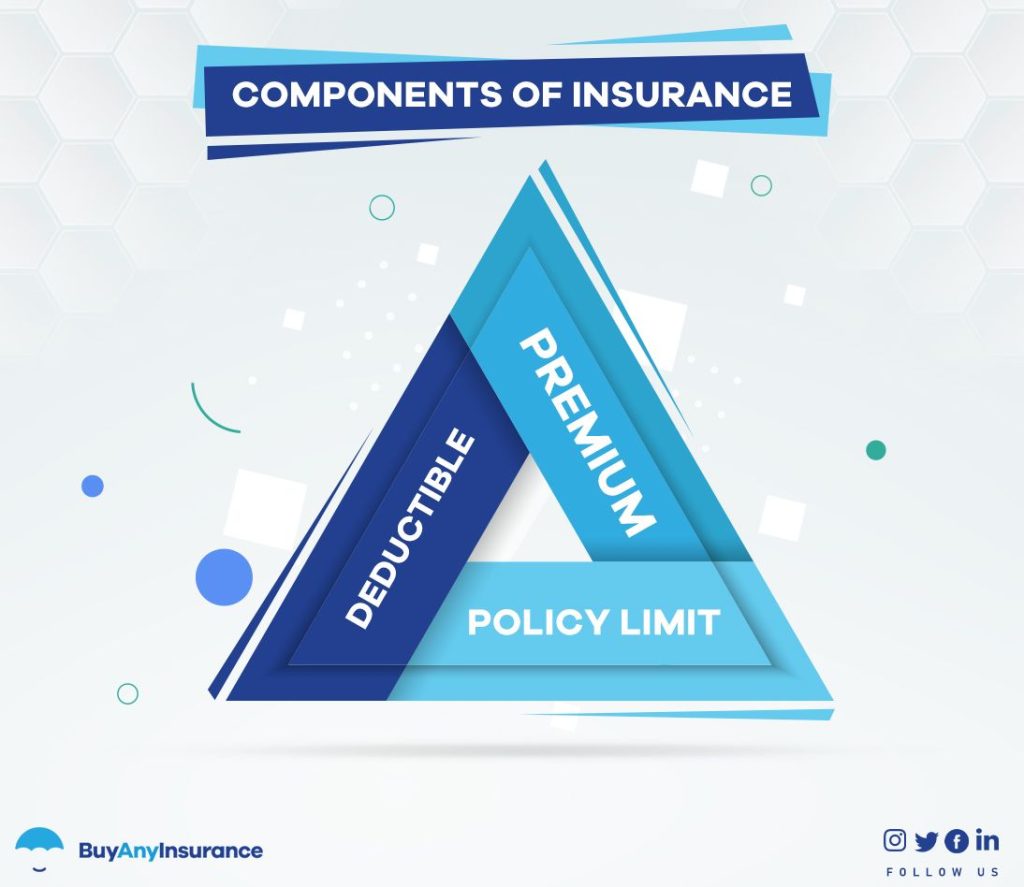

H2: Adjusting Deductibles Opting for a higher deductible can lead to reduced insurance premiums, albeit with increased out-of-pocket costs in the event of a claim. While this strategy involves assuming a degree of risk, it can be financially advantageous for responsible drivers who are unlikely to file frequent claims.

H2: Seeking Discounts Exploring available discounts is paramount for drivers looking to trim their insurance expenses. While insurance rates may not be negotiable, insurers often offer various discounts based on factors such as driving habits, vehicle safety features, and affiliations with certain organizations or professions. Being proactive in identifying and leveraging available discounts can result in substantial savings.

Final Thoughts

In conclusion, as the cost of car insurance continues to escalate, it’s essential for drivers to explore cost-saving measures without compromising adequate coverage. While switching providers, improving credit scores, adjusting deductibles, and seeking discounts are viable strategies, reducing coverage altogether is discouraged. Maintaining adequate insurance coverage ensures financial protection and peace of mind, particularly in the event of unforeseen accidents or liabilities.