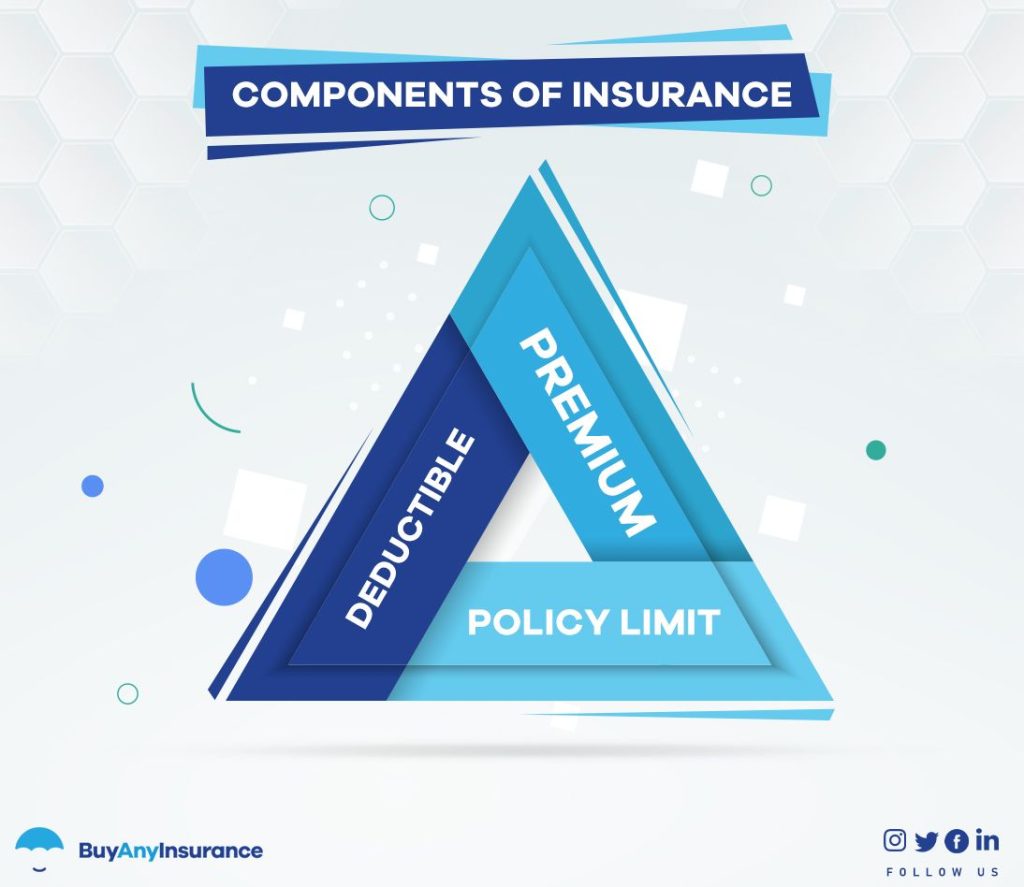

Insurance plays a crucial role in mitigating financial risks and providing protection against unforeseen events. Understanding the various types of insurance and their adoption rates across different regions, particularly in Europe and the United States, sheds light on the evolving landscape of risk management and financial security.

Types of Insurance

Life Insurance Life insurance offers financial protection to beneficiaries in the event of the insured individual’s death. It provides a lump sum payment or regular income to cover expenses such as mortgage payments, living costs, or education expenses.

Health Insurance Health insurance covers medical expenses incurred due to illness, injury, or preventive care. It ensures access to quality healthcare services without the burden of hefty medical bills.

Property Insurance Property insurance protects against damage or loss of physical assets, including homes, vehicles, and businesses. It provides financial compensation to repair or replace damaged property due to events like fire, theft, or natural disasters.

Auto Insurance Auto insurance provides financial protection against losses incurred as a result of vehicle accidents or theft. It covers damages to the insured vehicle, as well as liability for injuries or property damage caused to others.

Insurance Trends in Europe Universal Healthcare Systems Many European countries operate under universal healthcare systems, where basic health coverage is provided to all citizens. Private health insurance supplements these public systems, offering additional benefits and faster access to specialized treatments.

Regulatory Frameworks European Union member states adhere to strict regulatory frameworks governing insurance practices, ensuring consumer protection, solvency, and fair competition within the insurance industry.

Emphasis on Sustainability There is a growing emphasis on sustainable insurance practices in Europe, with insurers integrating environmental, social, and governance (ESG) factors into their risk assessment and investment strategies.

Insurance Landscape in the United States

Diverse Market Offerings The U.S. insurance market is characterized by a diverse range of offerings, including employer-sponsored health plans, individual health policies, property and casualty insurance, and life insurance products.

State Regulations Insurance regulations vary by state in the United States, with each state having its own insurance department responsible for overseeing insurers, licensing agents, and ensuring compliance with state laws.

Role of Private Insurers Private insurance companies dominate the U.S. market, offering a wide array of coverage options tailored to individual needs and preferences.